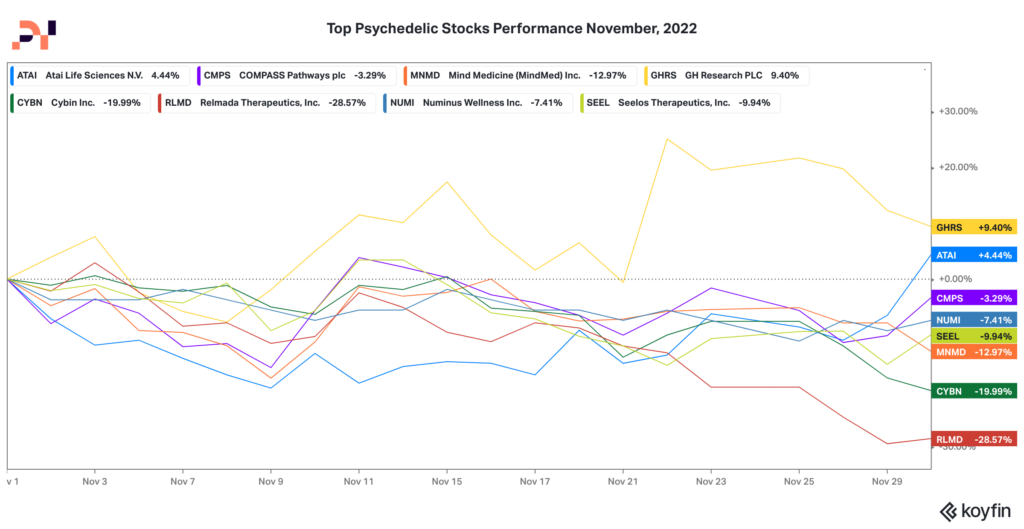

Let’s get straight to it: The psychedelic stock market continues to underperform.

Taking a look at our Psychedelic Invest Index, we can see that only two companies that trade for a greater than $50 million market cap were up in the month of November: atai Life Sciences (ATAI) & GH Research (GHRS).

Wait, there are only stocks trading at a greater than $50 million market cap?… You are probably asking yourself.

Five trading over $100 million…

And only two trading over $500 million.

Simply put, the psychedelic stock market has taken a beating. If you were to add up the market capitalizations for every psychedelic stock, it would ring up to less than $2.5 billion.

To put this in perspective, atai’s IPO at the height of the psychedelic bull market was worth more than $3 billion.

With that being said, let’s try to look at a few positive pieces of news from November.

Colorado Voters Pass Proposition 122 Legalizing Psilocybin

The votes are in, and Colorado citizens want access to psychedelics. On November 8, 2022, Colorado became the second US state to vote on a measure that legalizes psilocybin access in a therapeutic setting and decriminalizes personal use. Learn more here.

Venture Funding Strong

In November we saw two funding rounds that caught our attention. Although these rounds are not for public companies, the amount raised and valuations are worth noting for future public listings.

Sensorium Raises $30 Million

Sensorium Therapeutics announced it closed a $30 million Series A financing round for its compounds SENS-01 and Biodynamic Discovery Platform (BDP.) The funding round was led by healthcare and life sciences investment firm Santé Ventures, along with Iter Investments, Route 66 Ventures, CU Healthcare Innovation Fund, WPSS.bio, Palo Santo, Ocama Partners and re.Mind Capital.

Lusaris Therapeutics Raises $60 Million

Lusaris Therapeutics announced its launch with $60 million in Series A financing to advance LSR-1019, a sublingual formulation of 5-MeO-DMT for patients with treatment-resistant depression (TRD) and other severe neuropsychiatric disorders. The round was led by RA Capital Management, with participation from Venrock Healthcare Capital Partners, Deep Track Capital, and Boxer Capital.

For specific news into the public markets, in November our very own Adam Tubero did deep dives into both atai Life Sciences (ATAI) and MindMed (MNMD). You can view those below.