Although the Psychedelic Invest index had been performing well since the lows in May, September turned out to be a bad month for the market with the index down -9.02%.

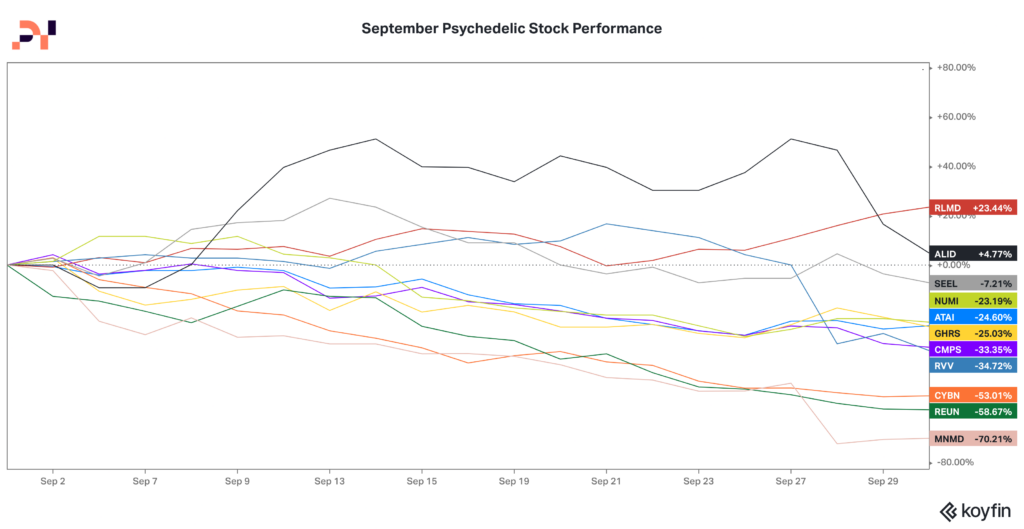

As you can see in the chart below, that’s because the large cap psychedelic stocks had a mixed performance in September.

While some stocks such as Relmada Therapeutics (RLMD) and Allied Corp (ALID) had positive performance, others such as Cybin (CYBN) Reunion Neuroscience (REUN) and MindMed (MNMD) brought down the index.

Although Relmada had positive performance in September – up 23.44% – as investors were looking forward to their Phase III results, the company ended up not meeting its primary endpoint, causing the stock to drop more than 80%.

What’s Up With MindMed?

In case you have missed it, our very own Adam Tubero was all over this story to explain what is going on at the company and why it was down more than 70% in September.

Cleaning Up the Index

Due to the macro environment and the performance of psychedelic-focused stocks over the past year, many companies in the space have begun to shut down or pivot away from psychedelics.

In September, Psychedelic Invest began investigating the amount of shutdowns in the space and concluded that as many as 15 psychedelic companies that were previously in our index have shut down in the past year. These include:

- Aion

- Captiva Verde

- Cypher Metaverse

- Empower Clinics

- Goodness Growth holdings

- Graph blockchain inc

- HAVN

- High Fusion

- Yourway (formerly Hollister Cannabis)

- Lattice Biologics

- M2Bio (formerly Wuhan)

- Minerco

- New Wave Holdings

- Roadman Corp

- Thoughtful brands

As unfortunate as this is to see, we don’t see this trend slowing down any time soon. There are many other psychedelic-focused companies trading right now that unless something miraculous occurs soon, will be forced to shutter.

Slowly, the psychedelic stock market is becoming more and more homogenous, with only the largest companies surviving.

Although Psychedelic Invest accurately called the bottom in May, 2022 for the overall sector, unfortunately it wasn’t the bottom for individual stocks.