ETF provider, Defiance, continues to prepare for the launch of it’s Next Gen Altered Experience ETF under the symbol PSY.

As previously reported by Psychedelic Invest, Defiance aims to take advantage of the burgeoning psychedelics market by becoming the second ETF to focus on the market.

The first psychedelics ETF, provided by Horizons ETF has successfully gathered $60 million in AUM with a 0.85% management fee. By comparison, Defiance ETF’s current prospectus states that it will have a 0.75% management fee.

The ETF is expected to start trading tomorrow, May 28, 2021.

Defiance Next Gen Altered Experience ETF Holdings

Defiance’s ETF will follow the BITA Medical Psychedelics, Cannabis, and Ketamine Index provided by BITA Indexes.

According to BITA, the index “tracks the performance of a portfolio of companies conducting legal activities under the national laws of the applicable country related to medical psychedelics, medical cannabis, cannabis pharmaceuticals and cannabidiol (“CBD”) derivatives, and ketamine.”

The index also requires the components to have a $75 million market capitalization as well as derive 50% of their revenues from the usage of psychedelics or cannabis.

Psychedelic Invest has gotten our hands on two, different documents that show the potential Top 10 holdings for this ETF. Below we will explore the two documents. Investors should only use the two tables below as a guide.

- Charlotte’s Web (CWEB) – 6.57%

- Aurora Cannabis (ACB) – 6.53%

- Cronos Group (CRON) – 5.74%

- Compass Pathways (CMPS) – 5.57%

- MindMed Inc (MNMD) – 5.53%

- Supreme Cannabis (FIRE) – 5.38%

- Corbus Pharms (CRBP) – 5.26%

- Zynerba Pharma (ZYNE) – 5.18%

- Alefia Health (ALEF) – 5.17%

- Numinus Wellness (NUMI) – 4.97%

On the other hand, according to a yet to be released PDF that Psychedelic Invest has acquired, the top 10 holdings are as follows…

- Seelos Therapeutics (SEEL) – 9.49%

- GW Pharma (GWPH) – 7.09%

- Charlotte’s Web (CWEB) – 6.68%

- Trulieve Cannabis (TRUL) – 6.65%

- MindMed Inc (MNMD) – 6.37%

- Compass Pathways (CMPS) – 6.32%

- Columbia Care (CCHW) – 6.01%

- Neptune Wellness (NEPT) – 4.42%

- Pharmacielo (PCLO) – 4.22%

- Supreme Cannabis (FIRE) – 3.65%

Note: Investors should note that Psychedelic Invest does not ultimately know what the final holdings will be, but the following lists should give some insights into the thought process. The top 10 holdings have yet to be officially announced, therefore, nothing is set in stone.

According to the prospectus: “as of May 5, 2021, the Index was composed of 21 constituents.”

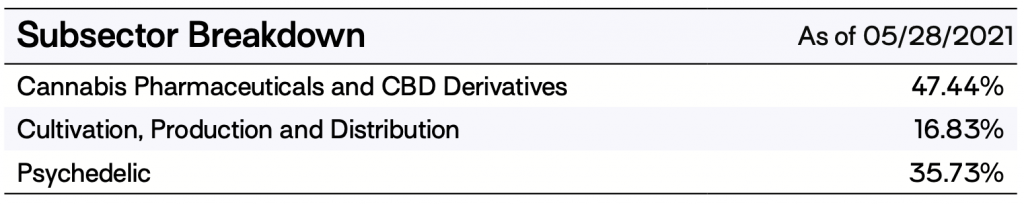

The PDF also shows the breakdown of holdings in line with their previous announcement of “35% in psychedelics healthcare companies and 65% in medical cannabis companies”

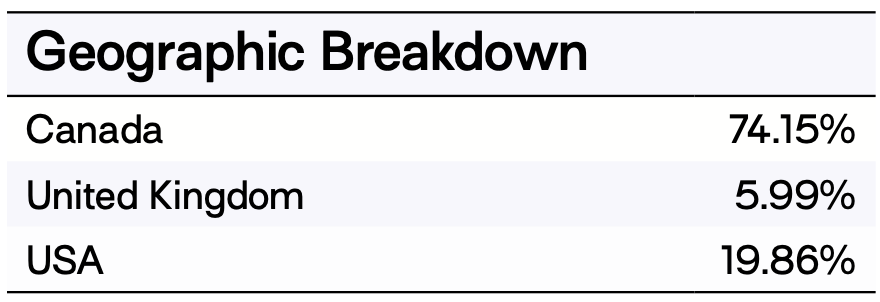

The geographic breakdown of holdings shows a heavy weighting to Canada, which is to be expected as the United States has been much more strict on cannabis and psychedelic public listings.

PSYK vs PSY

For those investors wondering whether they should invest in Horizon’s Psychedelic Stock Index ETF (PSYK) or Defiance Next Gen Altered Experience ETF (PSY), there are a few things to note.

1. Composition

Regardless of the final holdings, Defiance’s ETF managers have decided to diversify the holdings between psychedelics and cannabis.

On the other hand, Horizon’s ETF opted to focus on psychedelics, but diversify by the amount of focus on how much psychedelics impacts the company’s revenue. For example, Horizon’s ETF contains companies such as Johnson & Johnson (JNJ).

Both of these ETFs most likely have had to diversify due to the liquidity and market capitalization of currently listed psychedelics stocks.

2. Management Fee

Although fairly negligible, it is worth noting that Horizon’s ETF is currently .85% compared to the .75% proposed for Defiance’s ETF.

3. Location

Horizon’s PSYK ETF is focused on North America, whereas Defiance’s PSY ETF contains stocks that also trade in the UK.

4. Exchange

Horizon’s ETF (PSYK ) is currently only available to trade on the NEO exchange. Defiance’s ETF (PSY), on the other hand, will be available to trade on the NYSE, potentially giving the ETF much more exposure to potential investors.

Although the NEO exchange has been friendly to investors looking to trade psychedelic stocks, not all trading platforms currently support NEO listed stocks.

As we noted above, information will continue to be released regarding this brand new ETF which is expected to trade Friday, May 28, 2021.

Psychedelic Invest will continue to update information regarding the listing as we learn more.