In 2021, one of the leading stories for psychedelic stock investors was the introduction of ETFs focused on the burgeoning sector.

Here at Psychedelic Invest, we published multiple news alerts (here and here for example) and deep dives around the introduction of said ETFs.

But with the announcement from ETF provider Defiance last month that they would be shutting down their psychedelics focused ETF on August 30th, many investors began to fear that the hype around psychedelics was over.

Obviously psychedelics have an important role to play in the future of mental health. To add, the industry on any long enough timeline should be multiples of where it is today…

But in hindsight it looks like some companies jumped the gun in going public as we can see with even industry leaders like ATAI Life Sciences (ATAI) down nearly 80% since IPO.

This also seems to be the truth with psychedelics-focused ETFs.

Simply put, the air has been sucked out of the room when it comes to investor’s appetite for psychedelics stocks.

So, today we are going to take a look at where we stand in the psychedelics sector from the viewpoint of the four psychedelics ETFs (three live, one dead).

But before we take a look at how each ETF has performed, we need to understand how the ETF business works.

How ETFs Make Money and What That Means For Psychedelic Funds

Although there are a couple different ways that ETF providers earn money, they primarily generate revenue through management fees.

Note: For this exercise we are going to specifically discuss actively managed ETFs as opposed to passively managed ones in which there is much less effort to maintain the ETF from the managers perspective and thus less fees.

Because active ETFs take a lot of effort and capital to maintain, fund providers charge a fee for their effort. Although these fees can range anywhere from 0-10%, most actively managed ETFs charge ~1%.

Therefore, in order to understand how much a fund provider is making from an ETF, you can simply take the assets under management (AUM) and multiply it by the management fee to get a rough calculation of their revenue.

So, to put this in perspective, if an ETF has $100 million in AUM and charges a 1% management fee, it would generate $1 million in revenue annually all else being equal. Pretty simple right?

Now, with the above calculation we skipped over the fact that the ETF also will have some performance (either positively or negatively) which will impact that AUM number. For example, if the ETF had an outstanding year and increased in value by 100%, the AUM would now be $200 million, in turn generating $2 million in fees.

Therefore, as we can see, the two components that matter when it comes to running an ETF are:

- Money flows into the ETF

- Stock performance

To be clear, oftentimes the ETFs stock performance causes more money to flow into the ETF. Therefore, it is imperative that the ETF has positive performance if it wants to stay alive.

This is where psychedelic ETFs have run into some trouble…

- The psychedelics industry is a nascent market, with a total market cap of only a couple billion dollars currently. There simply isn’t enough investor interest at this stage to translate into a booming ETF market.

- The psychedelics market is down more than 50% off of its highs. As we explained above, stock performance is the leading driver of more AUM.

Combine these two facts, and being a psychedelics-focused ETF right now is a hard business.

So with that in mind, let’s take a look at how each of the ones on the market have and are performing.

Defiance Next Gen Altered Experience (PSY)

As previously explained, Defiance shut down their psychedelics-focused ETF on August 30, 2022.

Although we don’t have any insider information, we have to assume this has to do with the dwindling AUM. With an expense ratio of 0.75%, and less than $10 million AUM, the fund was most likely pulling down less than $75,000 in revenue.

The ETFs original prospectus stated that it would invest 35% of the fund in psychedelics healthcare companies and 65% in medical cannabis companies. But with both markets – psychedelics and cannabis – down significantly since Defiance’s psychedelic ETFs launch, the fund really never had a chance for success.

Horizons Psychedelic Stock Index (PSYK)

Billed as the “world’s first psychedelics ETF,” the Horizons Psychedelic Stock Index ETF (PSYK) was launched in January, 2021 on the NEO exchange.

As opposed to the Defiance psychedelics ETF (PSY) which diversified by including cannabis companies, the Horizons Psychedelic Stock Index ETF (PSYK) aimed to diversify its holdings by including large-cap pharmaceutical stocks such as Johnson & Johnson (JNJ) and Abbvie (ABBV). To be clear though, over time the ETF has become much more concentrated in psychedelics stocks with companies such as Seelos, Compass Pathways, and GH Research making up 17%, 14.5%, and 11% of the fund respectively.

Regardless, the ETF is still down more than 65% since inception and ~30% year to date.

At a 0.85% management fee and currently ~$25 million in AUM, the fund is currently generating more than $200,000 in revenue. This isn’t enough to continue forever, but it should be enough in our opinion to try to weather the bear market in psychedelics.

Advisorshares Psychedelics ETF (PSIL)

Launched almost exactly one year ago on September 16, 2021, the Advisorshares Psychedelics ETF (PSIL) was lauded by investors due to its pure-play nature of investing in psychedelic companies and lower fees (0.60%).

And although the fund showed initial success (as seen in the chart above) with the run-up of the Compass Pathways (CMPS) IPO, the fund is ultimately down more than 65% since inception and more than 45% year to date.

Now, with less than $10 million in AUM, PSIL seems to be in much of the same boat that PSY was in. With that being said, much of the retail investing community continues to support PSILs gameplan when it comes to investing in psychedelic stocks.

Elemental Advisors PSYK (NYSE: PSYK)

The newest fund on the market, having launched in February, 2022 is the Elemental Advisors PSYK (NYSE: PSYK). Investors should note that this ETF is not to be confused with the Horizons Psychedelic Stock Index (NEO: PSYK).

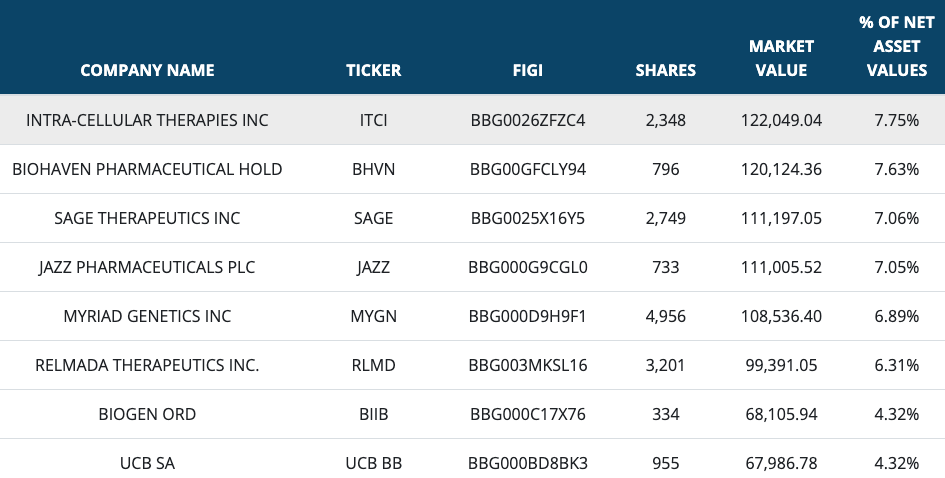

Although the fund claims on its homepage that it has “focused exposure to the medical psychedelic drug industry,” this isn’t necessarily true. A quick look over the funds top holdings and one would be pressed to find many psychedelics-focused companies.

Now to be fair to the fund, the prospectus does state: “If fewer than 25 psychedelic treatment companies qualify for inclusion in the Index, the Index will also include neurology biopharmaceuticals companies.”

Having launched only eight months ago, it is hard to make many conclusions yet on this ETF, but we can note that it has a 0.90% management fee which has been waived to 0.75% through 1/25/23. The fund also currently only has ~$1.6 million in AUM, so unless something picks up soon we can’t imagine the ETF will be around for long.

Verdict: It’s Hard to Be A Psychedelics ETF Provider Right Now

As we have hopefully shown above, being a provider of psychedelics-focused ETF is difficult right now.

The overall macro environment…

Simply put, trying to invest in a cutting-edge industry is more difficult than it might seem on face value. And as these ETFs continue to run into trouble they help increase the flywheel effect which is falling stock prices as they have to sell stock in the companies they hold.

But with all that being said, there are a couple areas of the market that are still hot on acquiring stock in psychedelics-focused companies. And in large amounts at that.

ARK Genomic Revolution ETF (ARKG)

Run by the infamous Cathy Wood, ARK Investment Management LLC, is a provider of multiple actively managed ETFs with more than $15 billion in AUM (although this number has been as high as $50 billion).

Ark Invest’s second largest fund is the ARK Genomic Revolution ETF (ARKG) which as of August 2022 has more than $2.7 billion in AUM.

The fund has a stated goal of investing in companies that “are focused on and are expected to substantially benefit from extending and enhancing the quality of human and other life by incorporating technological and scientific developments and advancements in genomics into their business.”

Although the fund does not explicitly state its intent to invest in psychedelic stocks, it hasn’t stopped it from gobbling up shares in some of the largest psychedelic companies. As of September 15, 2022, ARKG holds 6,242,194 shares (market value of $24,968,776) of ATAI Life Sciences and 394,986 shares (market value of $5,561,402).

To put that in perspective, ARKG holds more stock in psychedelics companies than all four psychedelic-focused ETFs combined. It is worth noting though that the two companies represent only ~1% of ARKGs fund.

ATAI Life Sciences (ATAI)

As should be obvious, ATAI Life Sciences is not a traditional fund in any way. Besides being a leading psychedelics company and one of the largest by market cap at that, ATAI also takes large positions in other psychedelics companies – both private and public.

On the public side for example, ATAI currently owns 22.5% of Compass Pathways (CMPS) as of June 30, 2022.

And now, after adding the $175 Million loan they took in August to the more than $300 million in cash on hand, ATAI has quite the war-chest to either go acquire private or public companies and/or double down on previous investments.

In a sense, ATAI is a sort of proxy for the large-cap psychedelics environment.

What’s the Future Hold?

As active investors in the space, it’s quite obvious that we have seen better times. As shown in the performances of each psychedelic ETF covered above, investors would’ve been better off if these indexes were completely avoided for most of 2022.

Interestingly though, and as we discussed in more detail in May, a bottom appears to have formed this past summer. If you were to look at each ETF (with the exception of Elemental Advisors), for example, you’d notice that stock prices have bounced back between the months of June and July.

Even our own index, which captures the entire basket of public psychedelic stocks, has gained back nearly all of its 2022 losses.

Good News? Yes. The latest rally is certainly promising for ETF providers and retail investors alike.

A reason to celebrate? Not quite.

Any downturn from here, given today’s gloomy economic and inflationary backdrop, could easily spell more trouble ahead. And with ETF money managers already skating on thin ice, there is a possibility of both share volumes and investor interest catering back to their lows.

As long-term investors, any subsequent bumps in the road should come as no surprise.

In the meantime, we’ll keep doing what we always do by stocking up our portfolio on only the down days and diversifying across this exciting sector as much as possible.